- Home /

- Blog /

- Exploring Pakistans Leather Exports A Guide On How To Run A Leather Export Business On Amazon

Exploring Pakistan’s Leather Exports: A Guide on How to Run a Leather Export Business on Amazon

Exports of leather and goods are experiencing a significant surge in the international market, holding promising implications for the people of Pakistan. This upswing presents numerous potential benefits, and we’d like to outline how you can capitalize on this positive trajectory.

As indicated by the Pakistan Bureau of Statistics (PBS), Pakistan’s exports of leather and goods witnessed an impressive growth of 10.94% during the fiscal year 2022-23 (July-June). Specifically, the export of goods displayed noteworthy increases: sports goods exports surged by 17.8% to reach $306.1 million, while leather goods exports grew by 5.1% to attain $98.697 million.

These figures underscore the substantial opportunities within the global market for sports and leather goods. Notably, in terms of international trade, the United States of America emerges as a pivotal player due to its robust and flourishing economy.

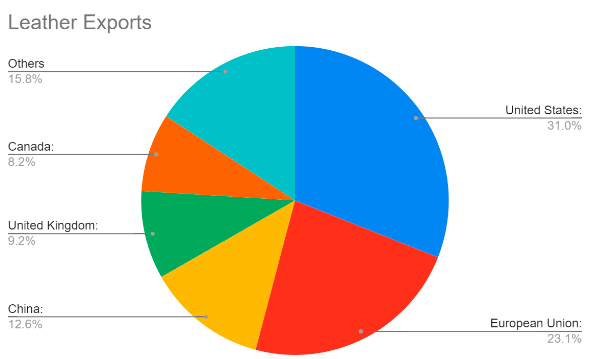

In the context of leather goods, the top five export destinations encompass the United States, the European Union, and China.

This escalating trend in exports not only demonstrates Pakistan’s potential to cater to international demand for these goods but also opens avenues for economic growth and prosperity. By harnessing these opportunities and tapping into the evolving preferences of global consumers, Pakistan stands to achieve considerable economic gains in the realm of leather and goods trade.

The vibrant tapestry of leather exports includes a diverse array of items, highlighting Pakistan’s craftsmanship. These items include:

- Leather garments, such as jackets, coats, pants, skirts, bags, gloves, wallets, and belts.

- Leather shoes, for fashion and various purposes.

- Leather furniture, car seats, and travel essentials.

The growth of the leather industry can be attributed to three factors:

- Global demand: The global market is increasingly demanding leather goods.

- Skilled workforce: Pakistan has a skilled workforce that can produce high-quality leather products.

- Government support: The government has provided strategic support and encouragement to the leather industry.

The future of this industry looks bright, with continued growth expected. This growth will create jobs and boost the economy of Pakistan.

How Pakistanis Can Benefit from this Rising Demand

The demand for leather products is very high. According to a report by Grand View Research, the global leather goods market is expected to reach USD 754 billion by 2028, growing at a CAGR of 7.4% from 2021 to 2028.

If you are interested in tapping into the leather goods market, there are numerous resources available to help you. The Leather Industry Development Council of Pakistan (LIDCP) is a government agency that provides support to the leather industry. The LIDCP offers training programs, financial assistance, and market research.

There is also the Pakistan Leather Export Council (PELC), a trade association that represents the leather goods exporters of Pakistan. The PELC offers a number of services to its members, such as market research, training programs, and export promotion.

In addition, there is a huge opportunity for Pakistani sellers to start doing leather business on Amazon. Amazon is the world’s largest online retailer and has a huge customer base. This means that there is a large potential market for Pakistani leather goods on Amazon.

In addition, Amazon offers a number of features that make it a great platform for selling leather goods. These features include:

- A large customer base: Amazon has over 300 million active customers worldwide. This means that your leather goods will be exposed to many potential buyers.

- Global reach: Amazon ships to over 185 countries. This means that you can sell your leather goods to customers all over the world.

- Fulfillment by Amazon (FBA): FBA is a service that allows you to store your products in Amazon’s warehouses and have them shipped to customers when they order. This can save you time and money on shipping.

- Seller Central: Seller Central is a platform that allows you to manage your Amazon business. This includes things like listing your products, tracking orders, and managing payments.

How Amazon is Growing In Pakistan

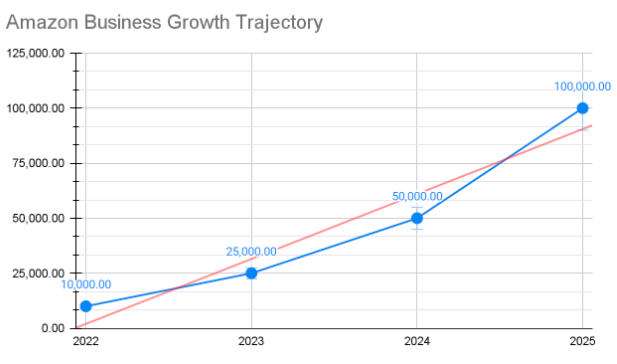

Amazon is a key player in enabling business growth in Pakistan. The meteoric rise of Amazon FBA sellers and Amazon affiliate marketers in the country is a testament to this. In 2022, Amazon FBA sellers in Pakistan generated a collective sales value of $100 million. On average, Amazon FBA sellers earned around $2,000 per month, while Amazon affiliate marketers earned a respectable $500 monthly.

The Amazon FBA community in Pakistan is projected to expand to 100,000 sellers by 2025. The Amazon affiliate marketing arena is also expected to grow to 50,000 participants during the same period.

How You Can Register a Business On Amazon and what documents are required for it.

There are two ways to register a business on Amazon:

Individual Seller Account: This is the most common type of account and is suitable for sellers who are selling products that they have manufactured or sourced themselves. To register for an Individual Seller Account, you will need to provide the following information:

- Your name and address

- Your bank account information

- Your tax identification number (TIN)

- Your credit card information

Professional Seller Account: This type of account is suitable for sellers who are selling products on a larger scale or who need to sell products that are restricted on the Individual Seller Account, such as alcohol or tobacco. To register for a Professional Seller Account, you will need to provide the same information as for an Individual Seller Account, as well as the following:

- A business license

- A resale certificate

- A tax exemption certificate (if applicable)

Once you have registered for a Seller Account, you will need to provide Amazon with documentation to verify your identity and business information. The specific documents required will vary depending on your country or region.

Here are some of the documents that you may need to provide:

Government-issued ID: This can be a driver’s license, passport, or other government-issued ID that shows your name, date of birth, and photo.

Business documents: This can vary depending on the type of business you have, but it may include a business license, tax identification number (TIN), or articles of incorporation.

Proof of address: This can be a utility bill, bank statement, or other document that shows your current address.

If you are a sole proprietor, you will also need to provide a Schedule C tax form from your most recent tax return. If you are a limited liability company (LLC), you must furnish your operating agreement. Upon thorough review and approval, Amazon Seller Accounts receive the coveted verification status.

How to register LLC from Pakistan

Here are some additional documents that might be sought under specific circumstances:

Bank Statements: Required for fresh bank accounts engaged in Amazon business.

Invoices: Essential for products not manufactured in-house.

Origin Certification: Mandatory for products imported, particularly into the United States.

What you need to do to export from Pakistan to the United States:

- Obtain an export license: If you are exporting restricted products, you will need to obtain an export license from the Export Promotion Bureau (EPB). You can check with the EPB to see if the products you want to export are restricted.

- Meet US import requirements: You will need to meet the import requirements of the United States. This includes things like declaring the value of your goods, paying any applicable duties and taxes, and following the correct packaging and labeling requirements. You can find more information about US import requirements on the website of the United States Customs and Border Protection (CBP).

- Find a reliable freight forwarder: A freight forwarder will help you book shipping space, arrange customs clearance, and track your shipment. They can also help you with the documentation and paperwork required to export to the United States.

However, if you are worried about the documentation and the complicated processes, which is the only hurdle in making your dream a reality, then Befiler is there to help you out.